What additional costs are incurred when buying a property?

19. March 2024

When buying a property, the focus is often exclusively on the purchase price, while at the same time other ancillary purchase costs arise that some buyers may not have in mind. In this blog post, we would like to inform you about the various costs that can arise during the purchase process in addition to the purchase price.

It is important to distinguish between mandatory ancillary costs and flexible ancillary costs. The mandatory ancillary costs are binding for every buyer and include tax and notary costs, among other things. On the other hand, there are flexible additional costs, which can vary individually. These depend, for example, on how the property was brokered or whether the buyer wishes to invest additional money for modernization or individual adaptations. Precise knowledge of both types of additional costs is crucial for comprehensive financial planning when buying a home.

Obligatory ancillary costs

1. notary fees and entry in the land register:

The legally valid completion of a property sale/purchase in Germany requires a visit to the notary, who certifies the sale or purchase transaction as an official person. The notary takes on the task of drawing up the purchase contract, creating the land charge, clarifying open questions and ultimately notarizing the entire purchase process. This service is accompanied by notary fees, which in Baden-Württemberg amount to 1.5% of the purchase price and are based solely on the purchase price. It should be noted here that the notary fees are not calculated according to the notary’s individual workload, but solely on the fixed purchase price. This means that the amount of the notary fees remains unchanged, regardless of the complexity of the sales process. Even in the case of a more complex sale, which requires a large number of questions and clarifications, the notary costs remain the same compared to a smooth notary appointment.

In order to become the owner of a property in Germany, mandatory entry in the land register is required. The land register acts as an official register that records in detail all notarizations of rights to land. This includes, for example, ownership, land charges and mortgages. The land register offices are responsible for keeping the land registers. The legally binding entry of the new owner in the land register is carried out by the notary, who takes on this task as part of the purchase process. This entry is accompanied by an additional fee, which is set by the land registry at 0.5% of the purchase price as remuneration.

2. real estate transfer tax:

After the buyers have received the tax assessment notice from the tax office, the payment of the real estate transfer tax is imminent. This tax is due when a property or share of property is purchased. It is payable once and is based on the purchase price. As the land transfer tax is a state tax, each federal state determines its own amount. In Baden-Württemberg, for example, it is 5% of the purchase price.

Some movable property may be exempt from land transfer tax. Our real estate agent Nina Weikmann has already made an information video on this topic on our Instagram account

and explained the whole issue. If you are interested in this more complex topic and would like to know more about it, you can watch Nina’s video at

:

https://www.instagram.com/reel/C3kpiTBoh2W/2iqsh=XBpejAxOG1qYWxq

Our Instagram account with our latest properties and regular updates from the team: https://www.instagram.com/maile_immobilien/

Flexible ancillary costs

1. broker’s commission:

For those who buy or sell their property through an estate agent, it is important to know that a commission is payable in such cases. This commission amounts to 3% of the purchase price plus VAT. It should be noted that these costs are not necessarily incurred by everyone, as not every property owner or buyer uses the services of an estate agent. The decision as to whether an estate agent’s commission is payable therefore depends on the individual choice and agreement between the contracting parties.

2. renovation and modernization costs:

Additional financial aspects that should be considered when buying a property relate to renovation and modernization costs. It should be noted that these costs are highly dependent on the individual characteristics of the property in question and do not necessarily arise in every case. Depending on the condition and features of the property, renovation work or conversion costs may be necessary in order to adapt the property to personal requirements or current standards.

3. appraisal costs:

When purchasing a property, it may make sense to have an appraisal carried out by an expert or real estate agent if no current appraisal is available. The appraisal costs incurred vary depending on the type and scope of the desired appraisal and the specific characteristics of the building in question. Particularly in the case of a comprehensive market value appraisal by a qualified expert, the costs can be at least €500 or more. However, investing in such an appraisal is an important measure to obtain a precise and well-founded valuation of the property, which in turn provides a solid basis for the entire purchase process.

4. relocation costs:

Moving costs are another flexible additional cost that can arise when buying a property. They depend heavily on whether you decide to hire a removal company or organize the move yourself. These variable costs offer buyers the flexibility to customize their relocation options according to their individual preferences and financial capabilities.

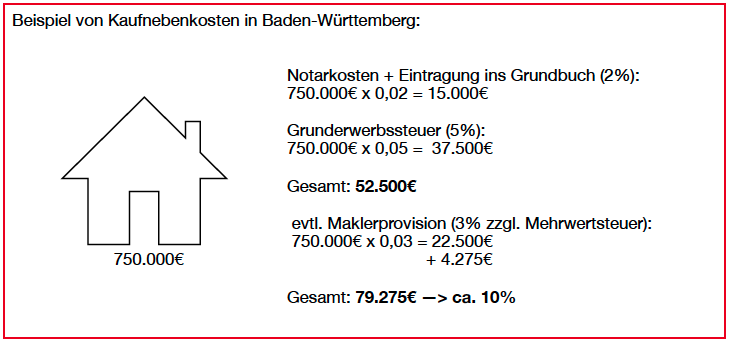

A sample calculation of the incidental purchase costs

In summary, prospective property buyers should expect average additional costs of around 10% of the purchase price when buying a property, with 5% being accounted for by land transfer tax alone. A conscious understanding of these additional financial expenses is of great importance, as they have a significant impact on the overall cost of the purchase.

In particular, it is advisable to cover the additional costs from the available equity, as banks are often reluctant to finance these expenses. This is because they do not represent a security value for banks and are therefore not secured in the land register.

Forward-looking planning and budgeting of ancillary costs are therefore crucial to ensure a smooth and financially calculable real estate purchase.

Sources:

- https://www.sparkasse.de/pk/ratgeber/wohnen/immobilie-erwerben/kaufnebenkosten.html

- https://www.stuttgart.de/rathaus/finanzen/steuern-und-abgaben/grundsteuer.php

- https://www.drklein.de/nebenkosten-hauskauf.html

More articles from Maile Immobilien

News

Nina Weikmann in an interview with Nadja Gontermann from Antenne 1 – tips for finding accommodation

Tipps & Tricks

Most people who have ever looked for an apartment in Stuttgart know how tough the process can be. It is either difficult to get a viewing appointment or to be selected as a new tenant. Last May, our real estate agent Nina Weikmann surprisingly gave an interview to Nadja Gontermann from Hitradio Antenne 1. Hitradio…

Read more

“You have to know how to be lucky!” Our Managing Director Michael Maile in an interview with Johannes Wosilat from The Hidden Champion

Uncategorized

Last summer, Johannes Wosilat from the podcast and video format "The Hidden Champion" and our boss Michael Maile met in the cozy atmosphere of our office for a not entirely private one-on-one conversation. Johannes uses his format to shed light on the people who achieve great things in their industry day in, day out and…

Read more

Energy-efficient renovation roadmap 2024! Our guide to saving costs & protecting the environment

Uncategorized

General information on the topic of renovation roadmaps The topic of energy-efficient refurbishment is currently becoming increasingly important. This can be attributed both to the effects of climate change and the associated concept of sustainability, as well as to the energy crisis, which has led to a rapid rise in energy prices. Energy refurbishment refers…

Read more